Originally published by Adrian Enright on 29 Jul 2021.

Carbon offsets play a critical role in corporate climate strategy. You simply cannot go carbon neutral or reach net zero without them. However, as the market demand grows and the role that offsets play experiences greater scrutiny, the need for proper due diligence on the projects that supply the offsets becomes even more critical. Working with a partner that understands the projects inside out will ensure your company (and your brand) purchase offsets that are of the highest standard.

Having worked for many years establishing carbon offset projects across Asia, I feel fortunate to have witnessed all angles of the projects – the protection of the forests; the benefit sharing arrangements amongst communities; the monitoring and evaluations completed by third parties.

Adrian in community consultation on a carbon offset project in Laos.

As new organisations enter the voluntary offset market, the temptation to put price above risk mitigation is a dangerous approach that can have serious negative impacts on brand. But not everyone is fortunate enough to have this on-the-ground insight. Instead, many ‘experts’ see carbon offsets as a universal commodity that can simply be purchased off a trading platform and implemented in a company’s strategy.

This recent article in the AFR is one of a set that takes a closer look at what lies beneath a company’s carbon neutral claims. It highlights the importance of a company understanding exactly what they’re buying, and how that purchase aligns with their broader values.

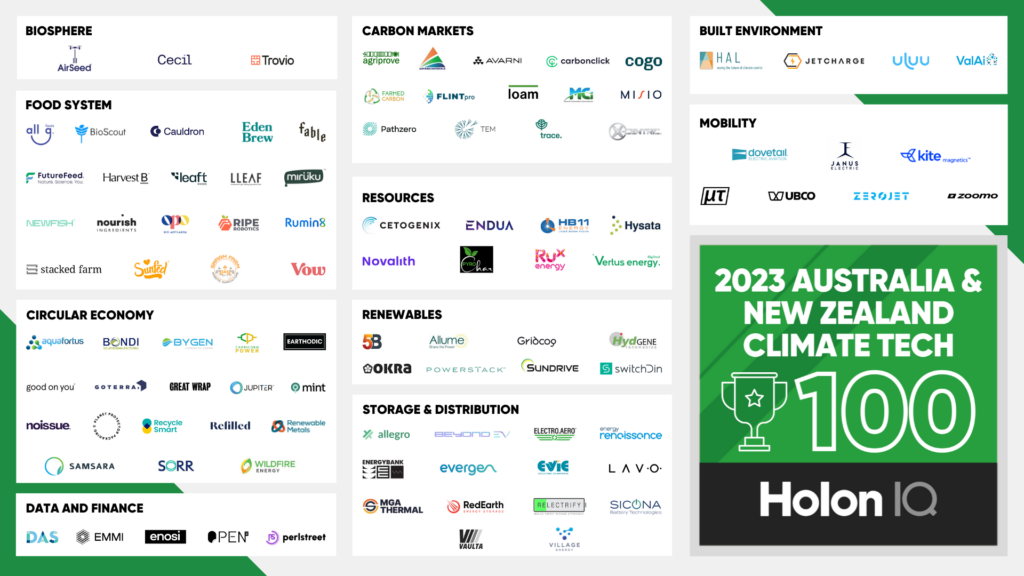

At TEM, this is something we take very seriously. In providing high quality offsets to our 60+ clients, we know we are representing their brand and their values.

To provide clients with confidence of the market integrity of the projects and the validity of the offsets procured, TEM undertakes a rigorous offset procurement process:

Step 1: Project identification

We research, travel, analyse and apply our deep international contact base to identify projects that fit within the eligibility of all international standards such the Australian Government’s Climate Active Carbon Neutral Standard.

Step 2: Project due diligence

TEM analyses the developer, owner, credit type, certification scheme, country and activity. We do this in tandem with the completion of a project risk model and a detailed due diligence check list. Providing a project meets our criteria to proceed, TEM collects full documentation from the project including Project Description, Validation Representation, Verification Reports and ongoing Monitoring Reports.

Step 3: Project negotiation and risk management

The carbon offset market is complex, with a multitude of supply and demand variables influencing offset availability and prices. Following the due diligence process, we analyse and balance policy & legal factors, technology factors, market & economic factors and project specific variables to ensure we procure a sufficient supply of offsets for our clients at guaranteed competitive prices throughout our negotiations with project developers.

Step 4: Offset procurement

TEM has developed a sophisticated proprietary trading platform (Miranda), combining all aspects of carbon procurement and offset retirement. Following negotiations, the team manages the contracting, purchasing, service delivery, stock control and retirements in real time, across all market channels and certification schemes.

Step 5: Offset retirement

Once the transaction is complete TEM provides evidence via a Certificate of Retirement to our clients to verify the offset units have been retired in the relevant registry.

Carbon offsets will play a fundamental role in all companies’ net zero strategies. You can’t go carbon neutral without them. So it’s wise to ensure your company understands what it is buying. The best way to do this is to work alongside of an organisation that has been on the ground and can validate the quality of the products that underpin your carbon neutral claim.